Mohamed Rodani

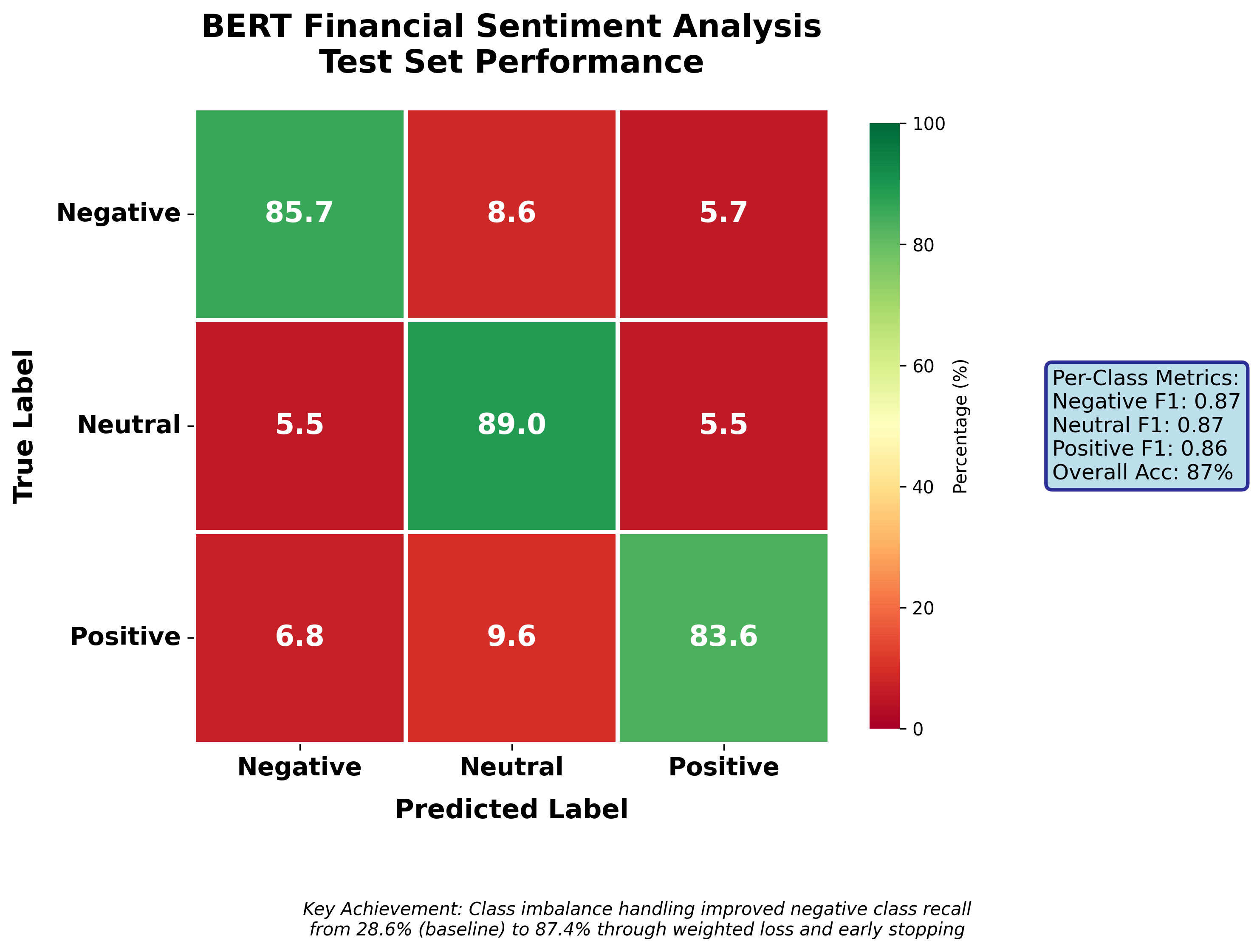

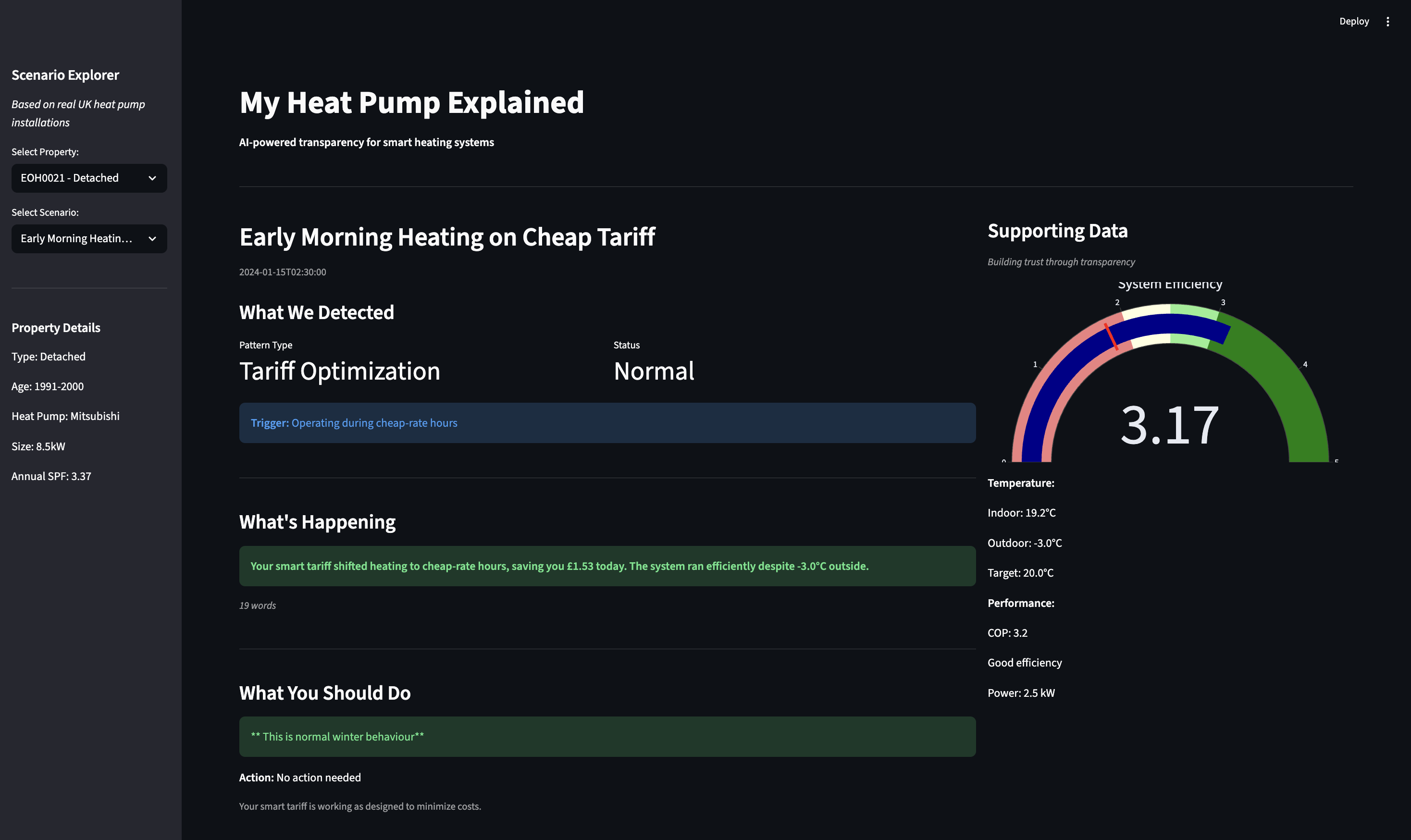

Physics @ QMUL • Machine Learning, Quant Finance & Scientific Computing

Turning messy problems into clear models and readable explanations. Rigor-first approach to building strong fundamentals through consistent learning and hands-on practice.